Facts About Transaction Advisory Services Revealed

Table of ContentsHow Transaction Advisory Services can Save You Time, Stress, and Money.The Only Guide for Transaction Advisory ServicesSome Known Incorrect Statements About Transaction Advisory Services Transaction Advisory Services Can Be Fun For AnyoneSome Known Factual Statements About Transaction Advisory Services

This step sees to it business looks its ideal to possible customers. Getting business's value right is essential for an effective sale. Advisors use different methods, like affordable cash circulation (DCF) analysis, comparing to comparable firms, and current deals, to identify the fair market worth. This helps set a reasonable rate and bargain properly with future customers.Deal consultants step in to aid by getting all the required details arranged, responding to inquiries from purchasers, and setting up sees to the service's location. Transaction experts utilize their expertise to aid company proprietors handle difficult arrangements, satisfy purchaser expectations, and framework deals that match the owner's objectives.

Fulfilling legal guidelines is essential in any kind of company sale. They aid organization proprietors in preparing for their following steps, whether it's retired life, starting a brand-new venture, or handling their newly found wealth.

Purchase advisors bring a riches of experience and expertise, making certain that every aspect of the sale is taken care of skillfully. Via calculated preparation, evaluation, and arrangement, TAS aids company owner attain the greatest feasible list price. By guaranteeing legal and regulatory compliance and handling due persistance along with various other offer employee, deal experts minimize potential risks and liabilities.

The Of Transaction Advisory Services

By comparison, Large 4 TS groups: Work with (e.g., when a possible purchaser is conducting due diligence, or when an offer is shutting and the buyer requires to integrate the company and re-value the vendor's Annual report). Are with costs that are not connected to the deal closing successfully. Earn fees per involvement someplace in the, which is much less than what financial investment financial institutions make even on "little offers" (however the collection possibility is likewise much higher).

, however they'll concentrate more on audit and appraisal and much less on subjects like LBO modeling., and "accounting professional just" topics like test balances and exactly how to stroll via occasions using debits and credits instead than economic statement modifications.

Facts About Transaction Advisory Services Revealed

Professionals in the TS/ FDD groups might additionally interview administration concerning everything above, and they'll compose an in-depth report with their findings at the end of the process.

The pecking order in Transaction Solutions varies a little bit from the ones in financial investment financial and exclusive equity professions, and the general shape appears like this: The entry-level duty, where you do a whole lot of information and economic evaluation (2 years for a promo from below). The following degree up; comparable job, however you obtain the even more intriguing little bits (3 years for a promo).

Particularly, it's tough to get promoted beyond the Manager level because couple of individuals leave the work at that phase, and you need to begin showing evidence of your capacity to create profits to breakthrough. Allow's begin with the hours and way of life considering that those are much easier to explain:. There are occasional late evenings and weekend break job, however absolutely nothing like Visit Your URL the agitated nature of investment banking.

There are cost-of-living modifications, so anticipate lower settlement if you're in a more affordable location outside major economic (Transaction Advisory Services). For all settings except Companion, the base salary consists of the mass of the overall compensation; the year-end reward could be a max of 30% of your base salary. Frequently, the very best way to raise your earnings is to switch over to a different company and work out for a greater salary and bonus

3 Easy Facts About Transaction Advisory Services Shown

You might get involved in corporate growth, yet financial investment financial obtains more challenging at this stage since you'll be over-qualified for Expert duties. Company money is still an alternative. At this phase, you should just remain and make a run for a Partner-level duty. If you wish to leave, possibly move to a client and perform their appraisals and due diligence in-house.

The main problem is that because: You usually require to sign up with one more Huge 4 group, such as audit, and work there for a couple of years and afterwards relocate into TS, work there for a couple of years and afterwards move right into IB. And there's still no guarantee of winning this IB role since it relies on your area, clients, and the hiring market at the time.

Longer-term, there is additionally some threat of and since examining a company's historic monetary information is not specifically rocket scientific research. Yes, people will always require to be included, but with even more sophisticated modern technology, reduced head counts might potentially helpful resources support client involvements. That stated, the Purchase Solutions group beats audit in regards to pay, work, and leave chances.

If you liked this write-up, you may be thinking about reading.

What Does Transaction Advisory Services Do?

Create sophisticated monetary structures that aid in establishing the real market worth of a firm. Give advising operate in connection to service assessment to assist in bargaining and pricing structures. Explain the most ideal kind of the deal and the type of consideration to utilize (cash money, stock, make out, and others).

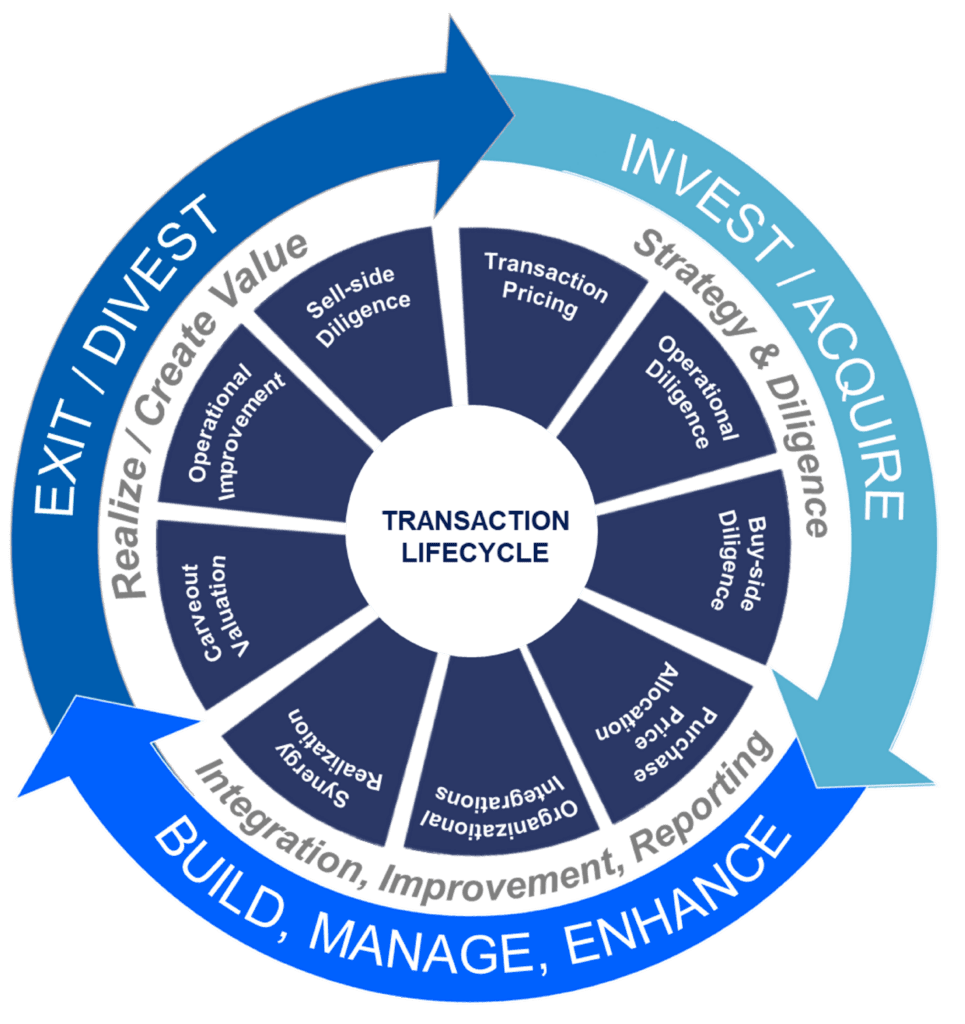

Carry out combination planning to establish the procedure, system, and organizational adjustments that may be called for after the offer. Set guidelines for incorporating departments, technologies, and organization processes.

Determine potential decreases by reducing DPO, DIO, and DSO. Examine the my site potential client base, sector verticals, and sales cycle. Think about the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The operational due diligence supplies vital insights right into the functioning of the company to be gotten worrying risk evaluation and worth creation. Determine short-term alterations to finances, banks, and systems.